Core Thesis

- Inflation + productivity + innovation + international expansion + population growth + acquisitions + stock buybacks → these all combine to make a company's earnings go up!

- Over time: Increasing earnings + dividends → stock market goes up

These are my notes from reading Brian Feroldi's book, Why Does the Stock Market Go Up? (paid link). The book contains a lot more info than I've provided here, but these were some of the parts I found most useful and interesting for where I'm at in my personal investing career. The images in this article are from Brian's wonderful substack, which I highly recommend checking out.

On Market Crashes

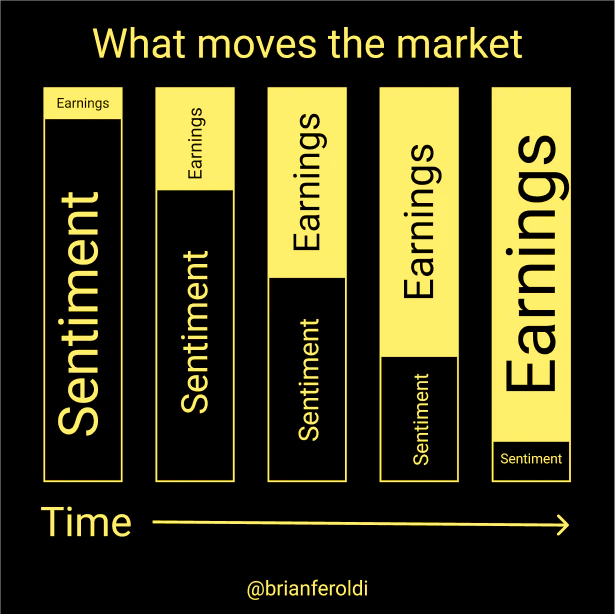

Stock market price-changes over short periods of time are driven by human emotions. This same fact makes big market crashes unpredictable. But the market always recovers over the long-term, because earnings continue to go up.

Crashes and downturns also help the market eventually go up in a few ways:

- Companies are forced to try new things. New technology, new methods, etc. Hard times breed innovation, tough people, and tough companies.

- Weak companies die off; strong companies survive. The strong ones ultimately take the leftover market share, and thus more earnings.

- Sometimes governments will “cushion the economic blow” if a downturn or crash is bad enough. They might create jobs, buy goods & services from companies, or even make cash payments directly to citizens / companies.

On Short Term vs Long Term Investing

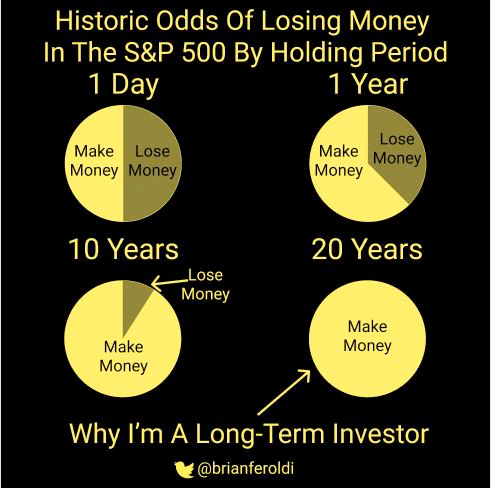

(We already said that ) emotion drives short-term changes & earnings drive long-term changes in stock market prices. Why? Over a short time period, investors can be overly-pessimistic or overly-optimistic. This can cause prices to trade much lower or higher than you might expect based on the company’s earnings. But over longer periods of time, emotions will matter less compared to earnings.

How long is “short term“ or “ long term”? It depends. Sometimes a company’s stock price and earnings can be out of sync for years. The longer the time frame, the more correlated the two will be.

It’s astounding how much the odds improve when time is on your side.

On Financial Advisors

Many financial advisors are just salespeople, and many aren’t even legally required to put your interests ahead of their own. Meaning: they will convince you to buy things that help them make $$$, even if it causes you to lose money. The book details a lot of other things to look for in a good advisor, good questions to ask, etc - but here’s just a couple of the most important points:

- Use an advisor that is “fee-only”, meaning they only make money when you pay them for their time, not by selling you special investments or by taking money from your portfolio.

- Avoid any advisor that trades in and out of companies (or the market) at a high frequency.

- “If you feel more confused after a meeting than before you went in, it’s probably best to find another advisor.”

Some Other Quick Hits on Various Topics

- “A business that is growing is worth more than a business that is not growing.” Why? Because if you wait a few years, the growing company will have much higher earnings, and that the core component of a how a stock is priced.

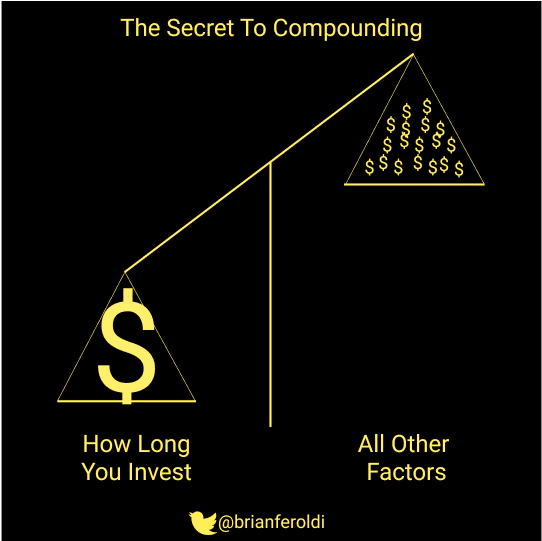

- “Compounding occurs when proceeds from an investment are reinvested over and over again to generate additional returns. This causes the investment to get bigger at a faster and faster rate over time.” It’s really hard for us visualize this - humans do well at imagining how things grow linearly over time, but not exponentially.

- The stock market returns about 10% a year, on average. It will never be exactly 10%, and some years will even be negative. But keeping your money there for many years will yield an average of 10% per year, which adds up to a lot over a lifetime.

- Dividend reinvestment is another way to compound your returns. Brian gives an example of a fictional character "Aaron" - his average yearly returns were 8% from price appreciation and 2.5% from dividends...might not seem like much of a difference, but if he’d spent the dividend instead of reinvesting, he would have only ~$1.5M instead of over $3M by the end of his career!

- Should I stop investing if the economy is doing bad? No:

“The best time to invest is when the economy is doing terribly.”

“...returns from the S&P500 are highest when the unemployment rate is above 9%.”

- Should I try to time the market? No. I'll write more on this in the future, but it deserves its own post.

- Saving is more important than investing. You can’t invest without first saving some money, after all.

Final Thought

If you're more than a few years into your investing career, there may be some sections of this book you already know all about. Don't be afraid to speed-read through those parts. But I'm willing to bet there are a handful of chapters on topics that will be new to you, like there were for me. This is also a book I'll be gifting to friends & family in the future as their investing careers begin, and I can't wait to have those conversations and watch them begin to invest their hard-earned dollars. Grab yourself a copy and gift away! (paid link)